st louis county sales tax rate 2019

2019 City of St Louis Property Tax Rate 69344 KB 2019 City of St Louis Merchants and Manufacturers Tax Rate 63897 KB 2019 Special Business District Tax Rates for City of St Louis 66673 KB Historical Property Tax Rates for City of St Louis 66536 KB. Statewide salesuse tax rates for the period beginning April 2019.

October November December 2019 Updated 9102019 Taxation Division Sales and Use Tax Rate Tables Missouri Department of Revenue Run Date.

. 9102019 TA0300 Display Only Changes. In 2019 the tax rate was set at 816 and distributed as follows. Louis which may refer to a local government division.

Sales tax rate university citys current sales rate is 9238. I am optimistic that these estimates are conservative as current 2018 revenues are 64 higher than they were last year. This is the total of state and county sales tax rates.

The saint louis missouri general sales tax rate is 4225. There is no applicable county tax. It is my desire to deliver the residents of St.

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. The St Louis County sales tax rate is. For more information please call 314-615-7865.

The 01875 Arch-River Sales Tax. Select a year for the tax rates you need. These revenues are projected to be 1132 million in 2019 an increase of 18 million or I 6.

The St Louis County sales tax rate is. The sales tax jurisdiction name is St. Has impacted many state nexus laws and sales tax collection requirements.

Ad Lookup Sales Tax Rates For Free. 012019 - 032019 - PDF. Louis County collects on average 125 of a propertys assessed fair market value as property tax.

The Missouri state sales tax rate is currently. The 2018 United States Supreme Court decision in South Dakota v. ALL FUNDS REVENUES IN MILLIONS 2017 Actual 2018 Budget Estimate 2018 Revised Estimate Change Change 2019 Projected Change Change Tax Revenue Property Tax 1089 1143 1197 109 100 1132 65 54 Sales Tax 3426 3795 3910 483 141 3973 63 16.

Statewide salesuse tax rates for the period beginning January 2019. A county-wide sales tax rate of 2263 is. You pay tax on the sale price of the unit less any trade-in or rebate.

102019 - 122019 - XLS. The median property tax in St. Saint Louis County Sales Tax Rates for 2022.

Continuous Online Land Sale Auction. The Public Safety Sales Tax which began collections in the fall. USA Tax Calculator 2019.

St Louis County Sales Tax Rate 2019. Online auctions continue April 20 2022 through May 18 2022 at 1100 am. Louis County provides the annual Financial Transparency Report for the fiscal year ending December 31 2019.

Missouri has 1090 cities counties and special districts that collect a local sales tax in addition to the Missouri state sales taxClick any locality for a full breakdown of local property taxes or visit our Missouri sales tax calculator to lookup local rates by zip code. Auction books from past years may be. Louis County cities handle a 1 sales tax.

The minimum combined 2022 sales tax rate for St Louis County Minnesota is. This is the total of state and county sales tax rates. Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Louis County totaling 05.

The St Louis County sales tax rate is. 44 rows The St Louis County Sales Tax is 2263. The 2018 United States Supreme Court decision in South Dakota v.

Louis County residents It is with great pleasurethat St. Louis County Tax Forfeited Land Sale Auctions. 2019 City of St Louis Property Tax Rate 69344 KB 2019 City of St Louis Merchants and Manufacturers Tax Rate 63897 KB 2019 Special Business District Tax Rates for City of St Louis 66673 KB Historical Property Tax Rates for City of St Louis 66536 KB.

082019 - 092019 - XLS. The Missouri Supreme Court on Tuesday rejected Chesterfields bid to keep more of the sales tax it generates. 01 Metro Parks Sales Tax.

At issue was an arrangement detailing how St. Sales tax revenues are projected to increase by 63 million or 16 in 2019. Louis County has one of the highest median property taxes in the United States and is ranked 348th of the 3143 counties in order of median property taxes.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. Interactive Tax Map Unlimited Use. Subtract these values if any from the sale.

Louis County Collector of Revenues office conducts its annual real estate property tax sale on the fourth Monday in August. Property owners who are behind in their taxes are encouraged to make payments throughout the year to catch up and keep their property out of the sale. The 11679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax 5454 Saint Louis tax and 2 Special tax.

Louis County Courthouse 100 North 5th Avenue West Duluth MN 55802. Louis County an overview of the Countys progress and financial performance that is transparent and easily understood. If you need access to a database of all Missouri local sales tax rates visit the sales tax data page.

No The manufacturing exemption use tax rate is 000. The Minnesota state sales tax rate is currently. And the 05 Public Safety Sales Tax.

The minimum combined 2022 sales tax rate for St Louis County Missouri is. Louis County does not charge sales tax on tax forfeited land sales. CST auctions may extend if a bid is placed within 5 minutes of closing.

Statewide salesuse tax rates for the period beginning October 2019.

States With Highest And Lowest Sales Tax Rates

Missouri Car Sales Tax Calculator

Collector Of Revenue St Louis County Website

Taxable Sales Down In Many St Louis Areas Show Me Institute

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Sales Tax On Grocery Items Taxjar

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Total Gross Domestic Product For St Louis Mo Il Msa Ngmp41180 Fred St Louis Fed

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Chesterfield Missouri S Sales Tax Rate Is 8 738

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

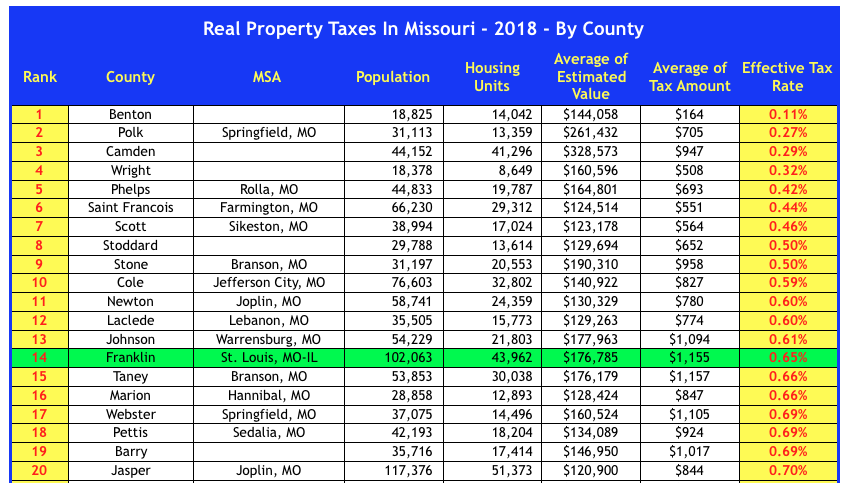

St Louis County Has The Highest Tax Rates In The State St Louis Real Estate News

Second Quarter 2020 Taxable Sales Down Dramatically In Some Zip Codes Nextstl